- Ron Winterton

- Mar 14, 2023

- 19 min read

Friends and Neighbors,

Last week marked the end of the 2023 General Session. For seven weeks, I worked alongside my colleagues to consider legislation on a variety of issues. Below you will find a review of some of the topics we addressed. I am grateful for the many individuals involved and all the hard work that went into the session. This year’s extraordinary budget provided a generational opportunity for our state to make significant investments and cut taxes for the third consecutive year.

We had many groups and individuals come visit us during the session. It was a pleasure to see Utahns getting involved in the legislative process. Though we are no longer in session, we will begin interim meetings in May which help prepare us for the next general session. I would appreciate your thoughts during the interim. You can reach me by email at rwinterton@le.utah.gov and phone at 435-299-8531. I will continue to send newsletters on a monthly basis to keep you informed.

Budget Overview

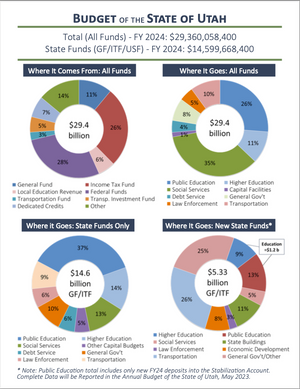

It is our constitutional responsibility to pass a balanced budget each year. Early in the session, we pass smaller, bare bones base budgets to ensure our state continues running even if there is a breakdown during negotiations. Near the end of the session, the Legislature passes what is referred to as the “Bill of Bills,” which allows us to supplement the base budgets with expanded appropriations based on the latest revenue estimates shared mid-way through the session. In this recent session, the “Bill of Bills” was more specifically known as S.B. 3 Appropriations Adjustments. Our total state budget this year was a remarkable $29 billion, the largest budget in Utah’s history.

Utah’s economy is in a strong position, ranking as the best state for economic outlook for 15 years in a row. However, the country is experiencing increased risks and volatility, with predictions of economic slowdowns. Utah is the best-prepared state in the nation for economic uncertainties. We are committed to ensuring Utah continues to be well-prepared for current and future needs by making strategic investments and wise budget decisions.

Tax Cuts

The 2023 General Session was a historic year for Utah, giving us the opportunity to provide the largest tax cut in state history. Over the past two years, the Utah Legislature has reduced taxes by nearly $300 million. To continue Utah’s commitment to reducing taxes and cultivating a family and business-friendly environment, the Legislature provided $850 million in tax relief for Utahns during the 2023 General Session. The tax cuts include reducing the income tax rate, expanding the social security tax credit, providing a double dependent exemption for those who have children under three and lowering the tax on motor fuel. You can learn more about additional tax cuts in the highlights below.

H.B. 54 Tax Revisions provides $607.9 million in tax cuts. The bill:

Reduces all Utahns' income tax rate from 4.85% to 4.65%. A $380 million reduction in taxes

Expands social security tax credit eligibility to individuals earning up to $75,000 per year. A $22.7 million reduction in taxes.

Provides a tax benefit for pregnant women by allowing a double dependent exemption for children in the year of their birth. A $3.5 million reduction in taxes.

Increases the earned income tax credit (EITC) from 15% to 20%. A $1.2 million reduction in taxes.

Removes the state portion of sales tax on food contingent on voters' approval to remove the constitutional earmark for income tax revenue during the 2024 general election. A $211 million reduction in taxes.

H.B. 301 Transportation Tax Amendments lowers the state tax on gas by two cents per gallon. A $32.7 million reduction in 2024.

H.B. 293 Tax Rebalancing Revisions (2018) maintain the decreases of the basic property tax levy freeze, preventing a $146 million future property tax increase. In FY 2024, the basic property tax levy will decrease from .001661% to .001356%.

H.B. 364 Housing Affordability Amendments provides a low-income housing tax credit for Utahns. A $51 million reduction.

H.B. 170 Child Tax Credit Revisions expands on H.B. 54, allowing a double dependent exemption for children one to three years old. A $9.6 million reduction in taxes.

H.B. 130 Adoption Tax Credit enacts an income tax credit for expenses related to the adoption of a child. A $2.6 million tax credit.

H.B. 151 Veteran Property Tax Revisions increases the amount of taxable value that a disabled veteran may have exempted from property tax to a maximum of $479,504. This number was adjusted from the 2015 amount of $252,126, with inflation considered.

Water Conservation

Utah is the second driest state in the nation. Over the last few years, our state has experienced severe drought. Though we received incredible snow and moisture this year, it’s imperative that we continue to plan for dry years and conserve water. In the past two years, we have allocated nearly a billion dollars for water conservation efforts and development, further mitigating Utah’s ongoing water issues and planning for future growth. This year, we passed several bills and allocated more than $500 million to address the diverse statewide water needs. The passed legislation ranges from subsidizing water efficient landscaping to implementing energy and water reduction efforts in local schools. You can learn more about additional water bills passed below.

H.B. 307 Utah Water Ways creates a statewide public-private partnership program called the Utah Water Ways which will educate Utahns, coordinate efforts to optimize the use of water and focus policy discussions about Utah’s water supply.

S.B. 118 Water Efficient Landscaping Incentives expands on the popular “turf buyback” program and allocates more funding to the program.

H.B. 491 Amendments Related to the Great Salt Lake continues efforts to restore the lake by creating the office of the Great Salt Lake Commissioner, who will bring the current state, local and private entities that have authority and responsibility for the Great Salt Lake together to ensure they are working in tandem for the betterment of the lake.

S.B. 76 Water Amendments incentivizes merging land use and water planning by providing state resources to local agencies to address the disconnect between water districts and other water-related entities in the state, aiming to improve communication.

H.B. 450 Water Wise Landscaping Amendments allows property owners in HOAs to use waterwise landscaping on their property and no longer permits HOAs to enforce policies that require lawns to be over 50% waterable.

H.B. 150 Emergency Water Shortages Amendments provides a framework and outlines the process for declaring a temporary water shortage emergency while addressing water use preferences during an emergency water shortage.

S.B. 34 Water Infrastructure Funding Study creates a study of water costs, and the use of property tax to fund water infrastructure, treatment and delivery.

S.B. 53 Groundwater Use Amendments changes state statute to allow critical management areas to recharge groundwater aquifers from alternative sources with excess water, allowing local districts to mitigate the decline of aquifers.

S.B. 119 Per Capita Consumptive Use implements a more accurate and efficient analysis of per capita water use in residential areas, assisting the progress of water conservation efforts with accurate reporting.

S.B. 191 Condominium and Community Association Amendments encourages water conservation, clarifying that HOAs cannot mandate watered lawns during a drought, and requires HOAs to adopt water-efficient landscaping rules.

H.B. 217 School Energy and Water Reductions allows representatives from the State Board of Education, Governor’s Office of Energy Development, Department of Environment Quality, Division of Water Resources and private energy providers to help more local education agencies reduce energy and water consumption.

S.B. 112 Aquatic Invasive Species Amendments addresses the problematic spread of quagga mussels by placing a $20 per boat fee for in-state boats and $25 for out-of-state boats. The funds will go towards hiring staff and other resources that will directly help mitigate the spread of mussels to more of our water systems.

Read more about Utah’s water legislation and conservation here.

Affordable Housing & Homelessness

Utah’s thriving economy is something we are proud of, and it has created a booming real estate market. However, when paired with rapid growth rates and limited housing, it has resulted in a shortage of affordable options. Additionally, homelessness in our Capitol city and across the state has risen dramatically. We cannot sit back and watch this happen to our communities or citizens.

This year, we passed several pieces of legislation and appropriated more than $200 million to address homelessness and housing affordability. We hope that this funding, along with the efforts of many dedicated individuals around the state, will create real change.

$52.5 million went towards the Utah Low-Income Housing Tax Credit (H.B. 364), which minimizes the amount of tax burden placed on low-income homeowners.

$50 million went to the First-time Homebuyer Program (S.B. 240), which provides Utahns with a loan of up to $20,000 to help first-time homeowners buy down interest rates, pay for closing costs or apply funds to their down payment.

$50 million went to Deeply Affordable Housing, helping aid one of our most vulnerable populations.

$15 million went to create teen centers for students experiencing homelessness. At these centers, teens will be able to find safety, support and resources.

$10 million went to Utah Housing Preservation Fund, which seeks to ensure that the affordable housing that currently exists in Utah continues to be available for individuals in need.

$7 million went to Box Elder Crisis Shelter and Transitional Housing.

$5 million went to Attainable Housing Grants, which will make homeownership a more accessible goal for Utahns.

$5 million went to the Shared Equity Revolving Loan Fund and $2.75 million went to the Rural Single-Family Home Land Revolving Loan Program, both of which will make needed funds available for families in our state.

$1 million went to the Critical Home Repair Program, which will go towards repairing the homes of low-income individuals.

$500,000 went to the Veterans First-time Homebuyer Program, which will provide a grant to eligible veterans that can be used for the first-time purchase of a home.

S.B. 240 First-time Homebuyer Assistance Program allocates $50 million to the first time homebuyer assistance program. This program helps an estimated 2,500 families receive a zero interest loan of up to $20,000 to buy down interest rates, apply funds toward a down payment or pay closing costs.

H.B. 364 Housing Affordability Amendments provides a low-income housing tax credit for Utahns who need it most.

Education

Funding education has been and will continue to be a top priority for the Utah Legislature. The Legislature passed significant funding for education during the 2023 General Session. This year, the Legislature appropriated $15 billion to public education and education programs, more than half of the state budget, and increased the WPU by 13% in ongoing funds and 18.5% in one-time funds. The funding included teacher salary raises, all-day kindergarten, educator preparation, school safety, teen centers and online education programs.

Here are a few of the budget highlights for public education:

$440.6 million went toward the Public Education Stabilization Account, which is used for the growth and stabilization of the public education system.

$239.4 million went toward increasing teacher salaries and students’ access to education opportunities.

$160.8 million went to the Permanent State School Fund. Investment earnings from this fund are distributed to every school in the state based on a per-pupil formula.

$50 million in one-time funding for critical small district capital infrastructure needs.

$30 million in flexible funding WPU distribution to 4th-6th Class County Schools.

$26.4 million in ongoing funding and $586,500 in one-time funding to increase the At-Risk WPU for English Language Learners and economically disadvantaged students.

$17.9 million to increase teacher salary supplement and educator salary adjustment raises to increase yearly with the WPU value instead of remaining stagnant.

The Legislature also increased funding for education programs in the state to continue to provide students with access to necessary resources to succeed academically.

Here are a few of the budget highlights for education programs:

$75 million in one-time funding to increase school safety, including increasing safety in school facilities and working with school safety specialists.

$64 million for educators to have additional contract hours for preparation, collaboration, grading and other professional activities.

$42.5 million for Utah Fits All scholarships, which allow parents to choose the best education for their children and receive up to $8,000 each year to pay for the child’s private or alternative education.

$25 million in ongoing funding to increase access to optional all-day kindergarten.

$15 million in one-time funding for teen centers that assist students experiencing homelessness.

$7.2 million to assist paraprofessionals in becoming licensed teachers.

$6 million in one-time funding towards meeting transportation needs of students.

$1.69 million to increase students’ access to online education programs.

Below are additional details about some of the legislation we passed to support our education system during the 2023 General Session.

H.B. 215 Funding for Teacher Salaries and Optional Education Opportunities Update creates the Utah Fits All Scholarship Program, which empowers parents to create a personalized education for their child. The scholarship prioritizes students from low and middle income families and funds up to $8,000 each year to pay for the child’s private or alternative education. Additionally, H.B. 215 doubles the funding in the Educator Salary Adjustment Program and increases teacher compensation directly by about $6,000 ($4,200 direct salary increase plus employer-paid benefits).

S.B. 183 Educator Salary Amendments is a companion bill to H.B. 215 that appropriates funding and ties the teacher salary supplement and educator salary adjustment raises to increase yearly with the WPU value, instead of remaining stagnant. Additionally, it makes all teachers eligible for these benefits until they have received three unsatisfactory ratings instead of one.

H.B. 477 Full-day Kindergarten Amendments expands access to optional full-day kindergarten statewide and funds kindergarten students as a full-weighted pupil unit.

S.B. 83 Public Education Funding Equalization redistributes education revenues across the state to areas that are most in need.

S.B. 55 Public School Instructional Material Requirements allows parents the opportunity to share public comment when a school board considers approving curriculum for the entire school district.

S.B. 100 School District Gender Identity Policies requires each school and local governing board to ensure a parent's right to access information regarding their child and prohibits a school from treating a student by a different gender identity without parental consent.

H.B. 209 Participation in Extracurricular Activities Amendments makes it possible for non-traditional students to join extracurricular activities outside the student’s public school boundaries. It also requires schools to collect and check students’ birth certificates before participating in high school sports.

H.B. 163 Protecting Student Religious and Moral Beliefs Regarding Athletic Uniform Requirements protects students' choice to wear religious or moral headwear and clothing, such as hijab, yarmulke, turban or other articles consistent with the student athlete's beliefs, during athletic activities.

H.B. 348 Participation Waiver Amendments gives parents greater ability to remove their children from school instruction or activities that they feel violates their right of conscience or religious beliefs.

Infrastructure & Transportation

Utah is the fastest growing state in the nation. To keep up with our state's rapid growth, it's imperative that we expand and improve our transportation systems and infrastructure. This session, we allocated $2.1 billion toward these improvements. In addition to funding, we considered many bills relating to vehicles, roadways, railroads, broadband, energy, aviation and more.

Here are some of the funding items and bills we passed that will directly impact our growing transportation needs:

$800 million was allocated to the Utah Department of Transportation for various transportation projects and enhancements around the state.

$775 million for high-risk debt avoidance and reduction.

$200 million in one-time funds for commuter rail improvements, including making the FrontRunner more competitive with automobile transportation.

$108 million to the Point of the Mountain and its various construction projects.

$100 million for enhanced bus service, tolling, a mobility hub, and resort bus stops for Big and Little Cottonwood Canyons.

S.B. 185 Transportation Amendments clarifies the allocation of responsibilities between the Utah Department of Transportation (UDOT) directors and requires UDOT to report to the Transportation Commission on legislatively funded capacity projects.

H.B. 26 License Plate Amendments modifies provisions related to standard issue license plates and creates the sponsored special group license plate program and changes the process to establish a new special group license plate.

S.B. 125 Transportation Infrastructure Amendments begins the process of planning for an electrified, integrated, smart transportation system and designates the ASPIRE Center as the lead research center for strategic planning for electrification in our state.

H.B. 301 Transportation Tax Amendments lowers the state tax on gas by two cents per gallon. To maintain our roads, Utahns will pay an additional $7 for car registration fees and a five-cent tax for each kilowatt hour charge at electric charging stations, counteracting the reduction in gas tax. Overall, it results in a $32.7 million tax reduction in 2024.

S.B. 30 Road Usage Amendments clarifies how the Utah Department of Transportation will manage and administer the Road Usage Charge Program Special Revenue Fund.

H.B. 232 Railroad Crossing Maintenance Amendments establishes a process for the Utah Department of Transportation to oversee railroad crossings and allows them to assign maintenance, responsibilities and costs among highway authorities and railroads. The bill also requires new or improved highway-railroad grade crossings to be funded solely by non-federal funds.

S.B. 175 Rural Transportation Infrastructure Fund creates the Rural Transportation Infrastructure Fund for highway projects in certain rural cities, towns and counties.

S.B. 161 Advanced Air Mobility Revisions creates the advanced air mobility sandbox to test regulations that will facilitate the development of advanced air mobility systems. It also constructs a study to examine suitable locations for infrastructure and vertiports, best practices regarding advanced air mobility, and different testing approaches for the technologies involved.

Child Welfare

S.B. 154 Adoption Amendments makes the adoption process more affordable by prohibiting a child-placing agency from charging adoptive parents for services that have already been paid for with public funds, prohibiting charges for services not actually rendered, and protects adoption agencies from anti-discrimination lawsuits based on the beliefs of an individual or religious institution.

S.B. 54 Child Welfare Parental Representation Amendments expands an existing pilot program to allow additional parental representatives in child welfare cases for low-income individuals. It also allows federal funds to be used under the Child Welfare Parental Representation Fund.

Courts, Law Enforcement & Domestic Violence

S.B. 117 Domestic Violence Amendments requires police officers responding to a domestic violence call to conduct a Lethality Assessment Protocol (LAP), a series of questions to assess the possible lethality of a domestic situation and creates a statewide LAP database.

S.B. 128 Public Safety Officer Scholarship Program creates a public safety officer scholarship program for high school students entering law enforcement careers.

H.B. 226 Sale of a Firearm Amendments creates a streamlined and efficient online process for private parties to voluntarily check if a purchaser holds a valid concealed carry permit, is a felon, and whether a firearm serial number is related to a report of a stolen firearm.

H.B. 107 Concealed Weapons Permit Fee Amendments waives the fee for a school employee, educator or staff member to obtain a concealed weapons permit.

S.B. 120 Property and Contraband Amendments pertains to the retention and disposal of evidence and contraband for class A, B, and C misdemeanors regarding documentation, disposal and the criteria for retention of evidence related to these offenses. The intent of this bill is to get property back to its rightful owners quickly and dispose of contraband and other items correctly in the proper time frame.

S.C.R. 3 Concurrent Resolution Encouraging Support for the Listen and Explain, Cooperate and Communicate Campaign encourages Utah’s law enforcement agencies to use the campaign to train officers how to actively listen to citizens' concerns during all interactions and then reasonably and respectfully explain, when possible, what action will take place according to the law or agency policy.

H.B. 314 Remedies for Victims of Domestic Violence Amendments, which would add four additional types of protective orders victims of domestic violence can use when ending a rental lease in order to move to a safer location.

Disability Assistance & Treatment

S.B. 106 Caregiver Compensation Amendments enables parents and caregivers to decide what option will provide the best care and quality of life for their dependents. If the federal Medicaid program accepts the state waiver, it will allow the spouse or family member who provides care to receive partial compensation through Medicaid for not being able to work.

S.B. 204 Autism Coverage Amendments aims to amend Medicaid coverage in Utah to include coverage for autism treatment services.

Healthcare

S.B. 133 Modifications to Postpartum Medicaid Coverage extends Medicaid coverage to women for a full year following the birth of a child, contingent on approval through the federal Medicaid program.

S.B. 35 Professional Licensing by Endorsement Amendments creates a compact for physician’s assistants in the state, allowing Utah professionals to cross state lines to practice and establishes a process for certain state agencies to issue some professional licenses and certificates by endorsement, upon the approval by the Utah Division of Professional Licensing.

S.B. 171 Health Care Practitioner Liability Amendments gives health care providers flexibility to deviate from medical norms when in the best interest of the patient.

H.B. 24 Prescription Discount Program Amendments allows the Public Employees' Benefit and Insurance Program to add 13 additional prescriptions to the discount program, including insulin and epinephrine, to help alleviate financial stress and benefit many who have serious and ongoing conditions.

H.B. 228 Unprofessional Conduct Amendments codifies a ban on conversion therapy while expanding legal protections for legitimate therapies. It addresses the confusion created by an administrative rule the Department of Professional Licensing implemented in 2019. The bill has consensus from all sides.

Mental Health

H.C.R. 6 Concurrent Resolution Regarding Mental Health Support in Schools highlights the critical role of school nurses, psychologists, social workers, and counselors and supports the creation of school formulas for better staffing mental health professionals.

H.B. 300 Voluntary Firearm Restrictions Amendments is a voluntary step to promote gun safety and accountability. It creates a voluntary firearm restricted list that allows someone to request to be restricted from purchasing firearms indefinitely, encouraging those who may be struggling with mental health issues or feelings of instability to protect themselves. Individuals can request to remove their names from the restricted list after 90 days.

Clean Air

S.B. 48 Energy Producer States' Agreement Amendments removes the now dissolved Energy Producer States’ Coalition from code and organizes the nonpartisan Energy Council, which will track matters of energy development pertaining to wind, solar, nuclear and fossil-fuel energy.

S.C.R. 2 Concurrent Resolution Regarding the Environmental Impact of Vehicle Idling encourages Utahns to be idle-free.

Parks & Recreation

S.B. 185 – Transportation Amendments provides $45 million funding for trail systems throughout the state.

H.B. 224 Outdoor Recreation Initiative creates the "Recreation Coordinated Investment Initiative" to manage, maintain, expand, restore and improve outdoor recreation infrastructure on public lands within the state.

H.B. 93 Outdoor Recreation Modifications increases the amount that may be used each fiscal year for the Recreation Restoration Infrastructure Grant Program

Environmental, Social and Governance

Utah has taken a strong stance against environmental, social and governance (ESG) standards. ESG is an investment framework used by some organizations where factors such as corporate climate policies or workforce diversity are considered when investing in an organization. When investments are made based on ESG considerations rather than capitalizing on a return on investment, the investments have lower performance. The Legislature passed several pieces of legislation this session that will protect Utahns' investments from being made based on subjective standards like ESG.

S.B. 96 Fiduciary Duty Modifications outlines what considerations an investor can and cannot take into account when making a government investment.

S.B. 97 Public Contract Requirements prevent a public entity from entering a contract with a company that engages in economic boycott actions based on ESG standards.

H.B. 281 Social Credit Score Amendments prohibits a government entity from behaving in a preferential way toward an individual based on a social credit score.

H.B. 449 Financial Services Requirements requires companies to disclose to customers if they use any subjective standards and, if so, receive permission from customers to use the subjective standards. Additionally, it clarifies that corporations cannot coordinate with each other regarding the denial of financial services for an individual.

S.C.R. 9 Concurrent Resolution Opposing Efforts to Weaken the Economy or Restrict Energy Supply encourages that state investments be void of ESG investments and calls on the state auditor, state treasurer and attorney general to take action against ESG.

Utah Now Has Two Flags

Utah is getting a new state flag! Since beginning the process in 2021, the State Flag Commission and Utahns have worked together to create a stunning new design. The new beehive flag honors our state with its symbolism and beauty.

Utahns have been involved in every stage of the flag design process. The final design was a result of over 3,200 flag design submissions, 2,500 of which were from Utah students, and almost 50,000 votes on the online survey.

Though the new flag design passed the Legislature, we made every effort to show appreciation for and preserve the legacy of our former flag. To honor its role in our state’s history, it will be designated as the historical state flag. As such, it will still be seen regularly at the Utah State Capitol and can be used by any constituent for personal use. Multiple states have two flags, including Texas and Ohio.

Other Legislation Passed During the 2023 General Session

In addition to the topics highlighted earlier, we passed legislation on many other important subjects. Below you will find a description of some of the additional bills we passed during the 2023 General Session.

H.B. 427 Individual Freedom in Public Education outlines that each LEA will assure the state board annually that instructional materials and classroom instruction are consistent with specific principles of individual freedom. These principles of freedom include that an individual is not inherently racist, sexist or oppressive because they are a member of a particular race, sex or sexual orientation or that character traits such as a hard work ethic is not considered racist.

H.B. 284 Public Library Background Check Requirements calls for criminal background checks for public library employees. This bill aims to protect library patrons, especially children.

S.B. 257 State Board of Education Amendments requires Local Education Agencies to issue high school diplomas to any students who receive an associate’s degree with certain minimum credit hours earned and receive an industry certificate with certain minimum hours. The bill also seeks to help teachers and families by exempting schools from assessments under certain conditions with an opt-out rate exceeding 50%.

S.B. 265 Education Data Privacy Amendments prohibits the sharing of certain student data except when required by federal law. It is a step forward in providing proper protection for students.

S.B. 138 Fraudulent Ticket Sales Modifications concerns the ticket resale market, and seeks to protect Utah consumers from invalid, fraudulent, or duplicated event tickets. The bill prohibits the knowing sale of more than one copy of the same ticket and adds requirements related to refunds for tickets sold on the secondary online market. This bill makes alterations to the Ticket Website Sales Act and the Ticket Transferability Act to further protect consumers from unknowingly purchasing invalid event tickets.

S.B. 121 Car-sharing Amendments removes a redundant tax that is currently charged when a car is rented peer-to-peer. Currently, an individual who participates in peer-to-peer car renting must pay sales tax when they purchase a car and every time they rent the car. The removal of the sales tax is conditional on a car owner showing that they paid sales tax when they purchased the vehicle.

H.B. 469 Wildlife Related Amendments makes adjustments to the regulations addressing wildlife habitat, hunting and fishing. H.B. 469 also adjusts trail camera usage on private property and cougar hunting regulations. The bill allows someone with a hunting license to hunt cougars without obtaining a tag to help manage the cougar population.

S.B. 201 Radon Notice Amendments allows for educational information about radon, an invisible and odorless heavy gas that naturally occurs in our environment, to be provided to residential property owners via a property tax notification. Utahns can purchase a radon testing kit here.

S.B. 247 Medical Malpractice Amendments ensures that sexual abuse is not protected under the Medical Malpractice Act and will hold health care providers accountable for their actions.

S.B. 108 Animal Shelter Revisions bans gas chambers as a euthanasia method, addresses euthanasia methods animal shelters can use and requires shelters to adopt a humane euthanasia policy and training program.

S.B. 46 State Holiday Modifications recognizes Diwali as an annual commemorative period in Utah and is celebrated on the fifteenth day of the Hindu lunisolar month of Kartik, which typically takes place between the end of October and the beginning of November.

S.B. 123 Boards and Commissions Modifications repeals nine boards and commissions and consolidates and streamlines several others.

H.B. 397 Urban Farming Assessment Amendments allows a piece of agricultural property to avoid rollback taxes and continue being taxed as agricultural land if it changes use to urban farmland.

S.B. 225 Commercial Email Act prohibits anyone from sending fraudulent or scam emails within Utah and creates a cause of action for when the email service provider, the recipient of the unsolicited email, and any person whose brand, trademark, email address, or domain name is used without permission.

H.B. 365 Voter Affiliation Amendments prohibits a voter from changing party affiliation between the candidate filing deadline and a primary election to prevent voters affiliated with a political party from switching parties and voting in the opposite party's primary election.

S.B. 24 Advanced Air Mobility Amendments organizes the provisions and implements a framework for advanced air mobility systems, including delivery drones, aerial mobility drones and other unmanned aircraft.

I am confident that we will continue to accomplish great things together. I am proud to be a Utahn and I am optimistic about our future. Thank you for the opportunity to serve in this capacity.

Kind regards,

Senator Ron Winterton

Utah Senate District 20

Comments